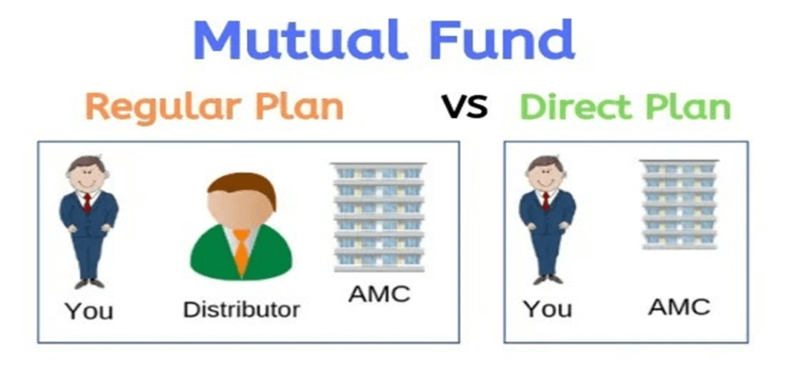

Nowadays, there is a lot of buzz regarding- why investors are moving their investment in Regular Scheme from Direct Scheme of Mutual Fund.

“Why would anyone increase their costs by keeping money in Regular Schemes?“

There are multiple reasons. Let me share a few of them:

1. Professional Guidance and Advice: While direct fund costs are lower than regular funds, the value of quality advice makes the additional cost worthwhile. For instance, investing as per equity market movement from choosing Small-cap to Mid-cap to Large-cap. Although the additional cost of regular fund was 0.3% to 0.8%, the benefit was remarkable 8%-9%.

2. Time and Effort: Managing your own portfolio demands significant time and effort, which could be more productively spent elsewhere. If this time were devoted to self-improvement, the long-term benefits would far outweigh the small cost savings on schemes & category.

3. Overcoming Biases: Qualified Advisors/Distributor help investors overcome human biases, leading to better returns. For example, they guide investors during market highs, provide direction during uncertain times, and encourage investing during opportunities, all of which justify the cost paid.

4. Goal-based Investing: Distributor/Qualified-Advisor assists in aligning your investments with specific financial goals such as Retirement planning, children’s education, wealth accumulation, or buying a house. They create customized investment strategies that prioritize achieving these goals within the desired time frame.

There are multiple takeaways, why one should opt for regular Plan, the critical is suitability & risk appetite of the individual investor. The small additional cost can give remarkable return, with appropriate approach, in every market situation by avoiding personal emotional attachment in Mutual Fund Investment.

Conclusion:

So ultimately the choice between a regular plan and a direct plan should be based on one’s individual needs, investment knowledge and whether, one value professional advice.

Gyaan Roots is always there to help you out if you need us. In case if you have any questions, you can respond to this email, and we would be happy to connect with you.